Tractor Supply up, expects tariffs to slow growth

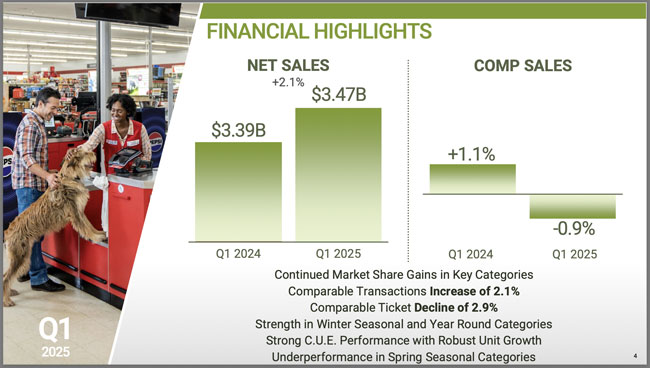

On April 24, Tractor Supply Company reported financial results for its first quarter ended March 29, 2025, showing net sales increased 2.1% to $3.47 billion. It showed a nearly 1% decrease in comparable store sales compared to an increase in the prior year’s Q1. A 2.1% gain in comparable average transactions was offset by a comparable average ticket decline of 2.9%. The company referenced declines in spring seasonal goods including related big-ticket categories. The opening of 15 new Tractor Supply stores in Q1 played a significant role in the company’s overall sales gains.

Tractor Supply reported its gross profit increased 2.8% to $1.26 billion from $1.22 billion in the prior year’s first quarter, and gross margin increased 25 basis points to 36.2% from 36.0% in the prior year’s first quarter. The gross margin rate increase was primarily attributable to disciplined product cost management and the continued execution of an everyday low-price strategy.

“As the year unfolds amid increasing volatility, our conviction in Tractor Supply’s resilient and durable business model remains strong. We have a long track record of navigating uncertain environments, and we believe we are well-positioned to do so once again,” said Hal Lawton, president and CEO of Tractor Supply.

“Since issuing our initial 2025 outlook, there has been a notable increase in uncertainty, in particular the introduction of new tariffs. In response, we are updating the range of our full-year outlook and providing guidance for the second quarter.”

The company repurchased approximately 1.7 million shares of its common stock for $94.0 million and paid quarterly cash dividends totaling $122.4 million, returning a total of $216.4 million of capital to shareholders in the first quarter of 2025.

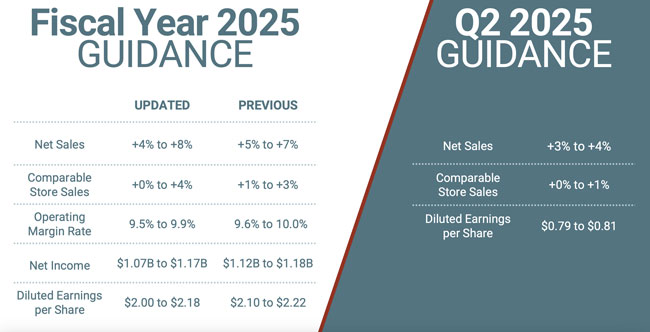

Fiscal Year 2025 Financial Outlook

Tractor Supply is updating its financial guidance for fiscal year 2025. Tractor Supply is actively working with its vendor and supply chain partners to navigate the impact of recently announced tariffs, while also monitoring the broader macroeconomic factors impacting its customers. For fiscal 2025, it expects net sales to grow by 4% to 8%, a change from its previous outlook of 5% to 7% growth.