Echo parent company reports 5% sales gains

Yamabiko released its financial results for the six months ended June 30, 2025, reporting sales of 91,288 million yen, an increase of 5.7% over the same period last year, and operating profit of 11,743 million yen, a gain of 3.1% year over year. Looking specifically at Yamabiko’s global OPE business, sales totaled 70,211 million yen, a 7.8% gain over the 65,112 million Yen in sales reported in the same period in 2024.

(Note: 1 USD = 149 Yen, and $617.25 Million = ¥91,288 Million)

The main overseas OPE business performed well in both North American and European markets, while domestically, the continued recovery in agricultural workers’ purchasing appetite led to growth in sales of outdoor power equipment and agricultural machinery.

In terms of profitability, operating profit increased due to improved production efficiency. However, selling, general and administrative expenses increased due to higher total personnel costs and promotional expenses. Ordinary profit decreased as foreign exchange gains that contributed to increased profits in the same period last year turned into foreign exchange losses due to the yen’s appreciation against the US dollar, resulting in a corresponding decrease in net profit.

By Region

North America

Sales of ¥49,215 million were mostly flat year over year, compared to prior year sales of ¥49,318 million. Sales to home improvement centers performed well due to favorable weather conditions and promotional effects including TV advertising. (Factoring in exchange rate impacts, Yamabiko said the YOY growth would have been 2.5%.)

Europe

Sales of ¥9,012 million were up 57.4% compared to ¥5,724 million for the same period last year. Revenue increased due to growing sales of new robotic lawnmowers and recovery in sales following dealer inventory adjustments that occurred last year.

Japan

Sales of ¥7,721 million were up 4.3% compared to sales of ¥7,400 million in the same period last year, a gain of 4.3%. Sales increased steadily for chainsaws, trimmers and brushcutters, pest control equipment, etc., driven by rising rice prices that boosted agricultural workers’ purchasing appetite.

Tariffs

Reporting on the impact of tariffs, Yamabiko said, “Although the company produces most of its US sales products at local subsidiaries, the supply chain span has multiple countries including Japan, resulting in some impact. In response to US tariff policies, the following measures have been promoted since April 2025.

- Accelerating production transfer plans to maximize utilization of US production facilities

- Company-wide promotion of further cost reduction

- Supply chain optimization through partnerships

Regarding tariff policies (15% on Japan) as of the August 8 earnings announcement, the plan is to minimize impact through pricing measures and additional cost reductions.

The expansion of 50% additional tariffs on steel and aluminum products announced on August 15 is currently under review to determine potential impact. Yamabiko defines that steel tariff as “Taxation on purchase prices of steel and aluminum materials contained in products and components.”

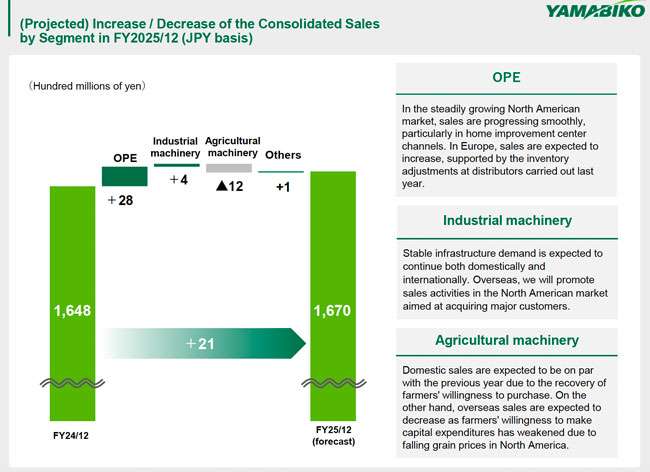

Outlook

Yamabiko said it is not altering its earlier full-year earnings forecast for FY2025 of around 1% growth in sales, saying, “there have been no changes from the earnings forecast announced on May 13, 2025.” For the OPE market specificially, it said, “In the steadily growing North American market, sales are progressing smoothly, particularly in home improvement center channels. In Europe, sales are expected to increase, supported by the inventory adjustments at distributors carried out last year.”

Robotics

- Expansion of turf management market, and robotic solutions.

- Yamabiko Europe and major US golf course management equipment manufacturer Toro have concluded a cooperation agreement.

- Jointly developing robotic products with unique specifications, while supplying and expanding sales of our products through Toro’s sales network spanning over 125 countries.

Robotic lawnmowers for Toro have shown smooth startup primarily in European markets. In addition to high evaluation of main models, the sales channel expansion effects from the collaboration are also appearing, and this is expected to be a future growth driver.