Tractor Supply sales climb 7.2% in Q3

Tractor Supply released its financial results for its third quarter ended September 27, 2025, showing that the retailer’s net sales increased 7.2% to a record $3.72 billion up from $3.47 billion in Q3 2024. Its comparable store sales increased 3.9%.

Tractor Supply said the increase in net sales was driven primarily by the growth in comparable store sales, as well as new store openings and the contribution from Allivet, an online pet pharmacy Tractor Supply purchased at the end of 2024. Comparable store sales growth was driven by strength in spring and summer seasonal products and continued momentum in core categories, especially consumable, usable and edible products.

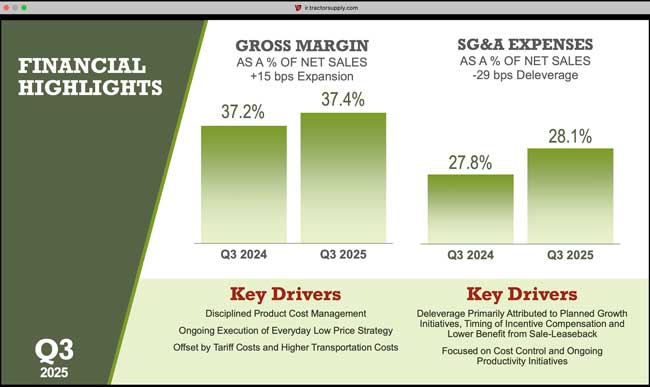

Gross profit increased 7.7% to $1.39 billion from $1.29 billion in the prior year’s third quarter. Gross margin rate increased 15 basis points to 37.4% from 37.2% in the prior year’s third quarter. Gross margin improvement from the Company’s ongoing focus on product cost management and the continued execution of an everyday low price strategy was partially offset by tariff costs and higher transportation costs.

“The Tractor Supply team delivered a strong third quarter. This performance was driven by ongoing share gains, agile execution through an extended summer season and healthy transaction growth,” said Hal Lawton, P and CEO of Tractor Supply. “As we enter the fourth quarter, we are well positioned for the fall and winter seasons, operating with discipline and controlling what we can control. With improved visibility on tariffs and the broader demand environment, we are narrowing our full-year guidance range to reflect our year-to-date performance and a balanced outlook.”

Selling, general and administrative expenses, including depreciation and amortization, increased 8.4% to $1.05 billion from $965.8 million in the prior year’s third quarter. As a percentage of net sales, SG&A expenses increased to 28.1% from 27.8% in the third quarter of 2024. The increase in SG&A as a percent of net sales was primarily attributable to planned investments, as well as the timing of higher incentive compensation as the Company lapped lower accruals in the prior year and a lower sale-leaseback benefit, consistent with expectations. These factors were partially offset by an ongoing focus on productivity and fixed cost leverage.

The company opened 29 new Tractor Supply stores and closed one Petsense by Tractor Supply store in the third quarter of 2025.