Mini skid-steer momentum: Why are so many manufacturers going small?

By Glenn Hansen

When Toro purchased the Dingo line of mini skid-steer vehicles in 1997, it included the 222 model. “Today, it’s very unimpressive,” said Tom Werner, general manager of Toro Sitework Systems, the division that oversees the manufacturer’s growing mini equipment line. “At the time, though, that was a breakthrough technology; it lived in an age when skid loaders, were prolific in the marketplace. And what would this small thing do?”

It would start a boom of mini machines. Toro, today, continues to produce model 323 which looks similar to that original 222. But, as Werner said during a press conference at Equip Expo, “the world has changed and now the Dingo represents a full line of compact utility loaders and has ultimately created an entirely new category for the compact construction industry.”

Where else would I begin this article on the growing market of mini machines?

After the Toro Dingo, the mini market began to mature. “It really started with four different companies: Toro; Bobcat; Ditch Witch; and Vermeer,” said Brant Kukuk, Ditch Witch product manager for compact equipment. “And it blew up from there. But those four companies really started this market. We were actually the second, it’s right behind Toro to enter the space. Funny now that we work together. And I feel like the competitors continued to chase either our gap or a head on model.” Toro acquired Charles Machine Works, the maker of Ditch Witch brand, in 2019 in a $700 million all-cash deal.

The momentum continues in this product marketplace. Quantifying the market is difficult today, without publicly available sales or production numbers. I’ve heard the total number of “mini” machines sold in the U.S. ranges from 35,000 to as high as 90,000. For comparison, the zero-turn mower market in the U.S. is nearing 1 million units at retail. Our friends at Power System Research estimate that 841,500 zero-turn mowers are expected to be produced in the United States in 2025. So mini is still relatively mini, but it’s moving up.

And what is a mini? Several manufacturers use the term “mini” to define a sub-category of compact equipment. Others stick with “compact.” When I spoke with Deere reps at Equip Expo, they wanted to avoid the term “mini” but the company’s website does include the word parenthetically in its compact excavator category. The category includes tracked and wheeled vehicles, mostly stand-ons but also some with seats and cabs. For this story, I was mostly interested in the stand-on and even walk-behind loader-type minis.

Why are people choosing Mini?

Since I’m a hands-on learner, I began my research into this market by borrowing a mini loader from one of the newest entrants into the category. Through its dealer Olson Power Equipment in North Branch, Minn., Kubota sent an SCL1000, its newest compact loader and only stand-on model (Kubota uses “compact” instead of “mini”), plus a couple attachments. I spent about a month with the machine, working in my backyard and on a few jobsites with the help of Steiner Landscaping based in Stillwater, Minn. More on that experience at the end of this story.

This market is blossoming for several reasons, and I cover three of the primary ones here. It’s about size, price, and convenience, which is a catchall category that includes ease of use and ownership, technology and more.

More Mini purchase drivers:

- Urbanization and confined job sites

- The need for maneuverability

- Residential and infrastructure boom

- Lower costs to purchase and operate

- Versatility with multi-attachment compatibility

- Technology features

- Advanced safety features

- Rental market efficiency

Size

I’m talking about both the size of the machines and the size of the worksite. When I asked Toro’s Tom Werner about the growth of the category overall, he pointed to data (backed up by data I found from the U.S. Census Bureau) showing that nearly “70% of all homes being built today are on 9,000 square feet or less, and 40% of all homes being built today are on 7,000 square feet or less.”

Toro and other manufacturers point to these smaller lot sizes as the “urbanization” of the U.S. home market. Werner continued, “And then the homes are being built on zero lot lines. In many cases, you can’t even get a full-size track loader between two homes.” For both initial construction and for ensuing landscape design or hardscape work, smaller equipment is not just convenient, it’s all that fits.

Smaller can be better than bigger, according to Doug Laufenberg, division sales manager for Deere, whether for the size of the job, or because it’s a homeowner renting one for ease of use. “Transportation gets to be an issue too, and smaller is better for hauling things,” he said. “It’s great for rental on the small end, just a lower cost, less things for operators to damage with a smaller machine.”

Seeing is believing

During my use of the small Kubota loader, I could see the ease-of-use factor and the potential benefit for a homeowner. I could also just see really well. “The primary building blocks of having smaller machines,” said Jake Sickels, product marketing manager for New Holland, “is based on the visibility factors, mainly the opportunity to sit inside machines up a little bit higher and have greater visibility outside around you. Even if you’re standing on the back of a machine, you still getting that same maneuverability, lifting capacity, hydraulic flow to run those smaller attachments, all while working in more confined areas; that’s what we’re looking at.” Sure, you can still get decent visibility on a traditional skid-steer or compact track loader but not like you would get with a mini track loader.

Price

Comparing price of mini equipment to more traditional compact equipment involves many factors, from initial cost (whether renting or purchasing equipment), cost of ownership (including maintenance, storage, transportation needs), and the cost opportunity for dealers that can now sell to a potentially new and growing market. That last category is a big one for New Holland and its dealers.

Compare the New Holland C314 mini track loader, priced at about $40,000, with the company’s C332 compact track loader, priced at about $75,000. That range is pretty consistent across manufacturers, give or take a few thousand bucks. And that can make a big difference for certain buyers. And it presents new market opportunities for dealers, especially for a manufacturer like New Holland whose dealers sell equipment that is much more expensive.

“Dealers love it,” said Sickels, of New Holland. “Of course, a dealer will need to sell 20 of these [C314 mini loaders] to sell one combine. However, they get more individual connections when selling construction machines because it’s one after another as opposed to one machine that’s going to last 10 years, they’re selling fleets of machines at a time.” (The retail price of a New Holland CR10.90 combine starts around $600,000 and goes up from there).

Increasing opportunities in the construction and landscape markets is a big driver for New Holland to expand beyond its home base of agricultural equipment. Over the last few years, New Holland has made an effort to grow the construction and landscape side by making retail opportunities more distinct from the ag side. “Now with the increase of our different product options, like small articulated loaders going into landscape opportunities, now we’re able to separate those a little bit better,” said Sickels.

While more affordable than a traditional compact loader, these mini machines are still not cheap. Enter the rental industry. “This price on this 17 P-Tier is about $40,000,” said Deere’s Laufenberg. “Our dealers have their own rental strategy; we encourage them to get into that business. It’s a big part of the compact industry.” He added that the compact (Deere’s “mini”) excavator and track loader are the two largest volume machines in that business. “And landscaping is key to both of those machines,” he said, with rental being a main access point.

Looking at rentals, I searched online to compare daily and weekly rates for mini loaders and traditional compact loaders. Prices vary be region and rental business, but a mini loader, like a Dingo generally costs $100 less per day to rent than a larger Cat loader. And that translates to $500 per week.

A manufacturer such as Ditch Witch, meanwhile, focuses on the breadth of its own mini lineup to satisfy an increasingly diverse market, for both dealers and users. “Some owner operators buy small at first and wish they had gone bigger a year later,” said Brant Kukuk. “So we allow the customer to grow with us by staying in our product lineup because we have a small stand on mini loader all the way up to a full size stand on.”

Convenience

The price factor applies to many potential buyers. The size factor applies to most potential buyers. The “convenience” factor applies to all. I’m talking about a variety of benefits here, including attachments, technology features, plus ease of use and ownership that can help owners with labor and more. Let’s start with labor.

“We have labor challenges in this market,” said Toro’s Werner. “These small utility loaders are more capable than ever. This helps improve the lives of the workers.” Werner talks about the machine’s quick learning curve and easy accessibility along with the capabilities in small spaces. That leads, he says to workplace improvements. “A lot of times we talk about how hard it is to get labor, if we could just focus on how we keep the labor we have and keep them in the industry, we could solve a lot of our problems,” he said.

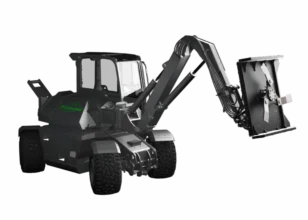

And that brings us to attachments. “A machine can do a job, but not without an attachment,” said Kukuk of Ditch Witch. The manufacturer has grown its share in the tree-care business, in part due to a relationship with Branch Manager, a Minnesota-based manufacturer of attachments that serve arborists, among other landscape pros.

“We realized there was a need in the market to support the attachment side of the arborist business. So we partnered with one of the best brands out there and we launched five different attachments to help arborists do their jobs. That’s been very successful for us to support this market.”

High-tech capabilities

The nascent technology side of these mini machines is a developing story for both users and business owners. And if a manufacturer does not offer tech features on its machines, it’s missing out.

“If you’re the owner, you can connect and monitor machine location and fuel level,” said Laufenberg. “Sometimes you can put in a code and check out how operators are performing versus another.” That kind of connectivity is increasingly important for business owners and it’s possible in a variety of machine types, from mowers to loaders. “As you grow up in our product line with the telematics,” said Laufenberg, “you can get alerts if there’s something going wrong with a machine. You can prevent something major from happening. Telematics is becoming very important for not only location and asset management, but also for managing the equipment so it can stay productive and not have as much downtime.”

Farmers and construction operators already know about the technology possibilities for proficiency in grading, digging and detailed sitework. These advancements are relatively new to mini loaders and excavators, but they are coming for most manufacturers. The landscape market will decide how much tech is needed on site to build a retaining wall or complete an irrigation install. That will, of course, vary by business.

Technology advancements have traditional equipment makers boasting about their high-tech capabilities as much as torque and power ratings. “CNH acquired a company called Hemisphere GNSS in 2013. Since then, we’ve been working with the Hemisphere team to develop in-house machine control solutions,” said Sickels. “Customers can buy a machine, they can buy their attachments, and they can buy their technology all in a single location, and that can also be financed with CNH finance.”

Final thoughts

Such brand building is better for manufacturers than for users of this smaller equipment. What buyers want is small machines that can help them do more work for less money. And they will find increasing value in technology, but those features will develop to meet the needs of users, not necessarily to create the need.

Buyers will and should look at features, controls and the specifications they need to get work done. What can they get on a trailer? How many attachments? Lift height and angles, horsepower, fuel type, maintenance requirements, etc. How quickly can a crew get to work? In the end, mini loaders are popular for their low-cost utility right now, as the rental market proves.